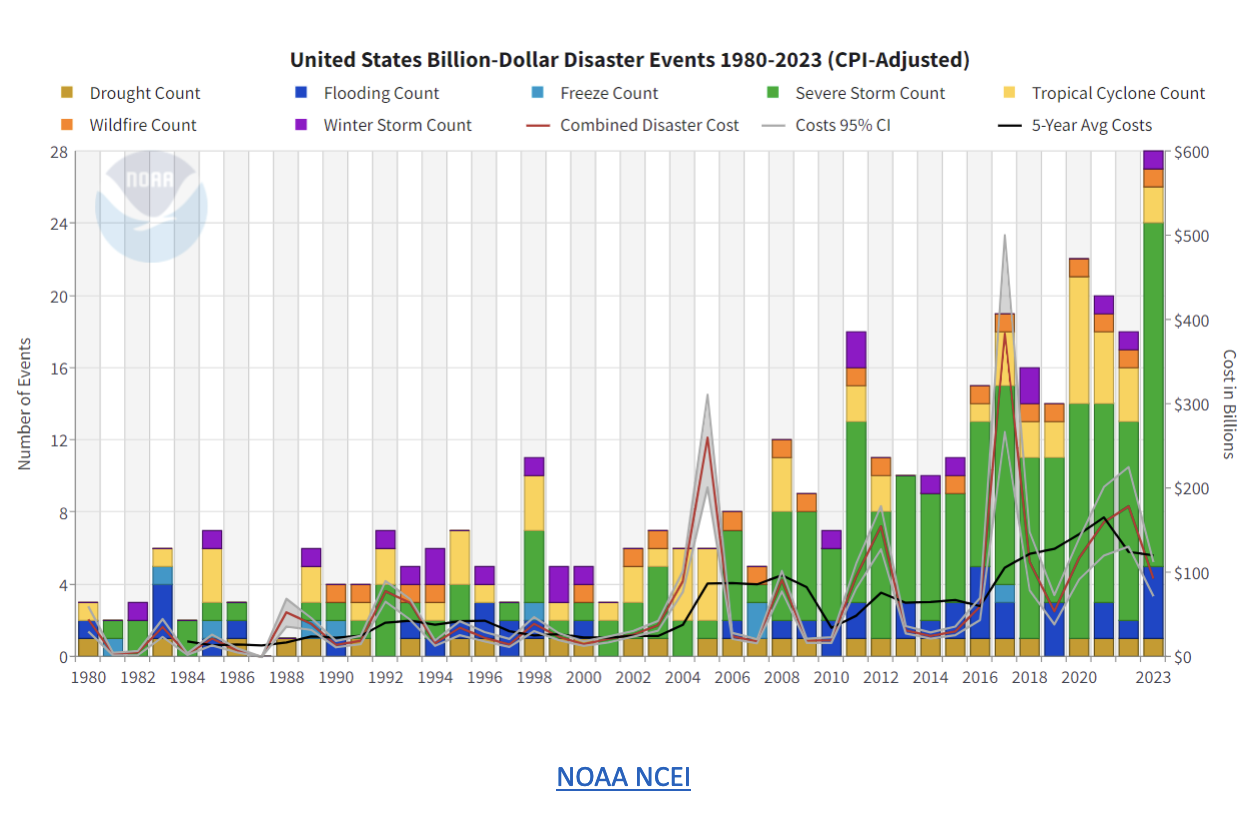

If you need more proof of climate change, look to the insurance markets. The increasing frequency of natural disasters have driven major insurers from heavily exposed states like California and Florida. The number of billion-dollar disasters has increased precipitously over the last 20 years, challenging the liquidity of insurance and reinsurance providers. Homeowners are forced to either accept inflated premiums or turn to state-run insurers of last resort, who have taken on trillions of dollars in exposure. The insurers, reinsurers, and state-run funds have developed an external market hoping to diversify risk exposure and provide alternative streams of cash. The novel securities, known as catastrophe bonds, have provided investors with an investment that is near-independent of macroeconomic conditions and insurers with a much broader pool of capital.

Here’s how it works:

An insurance company enters into a reinsurance agreement with a special purpose vehicle (SPV) or other external party. The SPV then issues catastrophe bonds to external investors. The premiums from this reinsurance contract provide the coupon payments for the bonds. The SPV holds the principal from investors and keeps it in a risk-free account. If the bond is not “triggered” by a catastrophe, the investors get back their principal, the accrued risk-free interest, and an additional coupon from the issuer. If the bond is triggered, however, the principal is kept by the issuer to cover losses.

The bonds are defined by term, area of coverage, and trigger mechanisms. Cat bonds’ maturity tends to range from 3 to 5 years. This timeline allows insurers to lock in rates and exert downward pressure on reinsurance prices. The area of coverage is both geographic and related to the specific catastrophe. For example, a bond issued by the Everglades Re II LTD vehicle provides coverage in Florida for named storms only (hurricanes and named-tropical storms). Covered areas can include metropolitan areas or the entire United States, and catastrophes sre a diverse group spanning tornadoes, earthquakes, hailstorms, and volcanic eruptions. The two most common trigger mechanisms are indemnity and parametric based. An indemnity trigger is based on the losses incurred for the issuing insurance group. In the case of the Everglades Re bond, the Class A tranche is triggered by $13.309 billion in losses over the 3-year maturity. Parametric triggers are determined by the magnitude of the covered catastrophe. The MetroCat Re 2023-1 bond, issued by the New York City MTA, is triggered by 8 feet or more of storm surge at certain tide gauges. Parametric triggers have the advantage of a quick turnaround, while indemnity triggers may take years to determine whether a bond payout is necessary or not.

What’s the appeal?

Returns are uncorrelated with broader economic conditions; some counterparty risk

High returns: over half of bonds outstanding have over 6% spread over benchmark rates; 10% of bonds outstanding have over 12% spread on benchmark rates

Clear risk: losses are based on measurable events; loss events can be modelled probabilistically; historical data can be more robustly applied to present assessments of risk

The market is clearly expanding with over $11 billion in bonds issued in 2024 and nearly $50 billion in bonds outstanding. We bring this to attention not for retail investing, but to illustrate how industries can creatively use fixed-income products to diversify capital pools and redistribute risk. Catastrophe bonds are an accelerating product whose success has large implications for the insurance market.