The Fed’s announcement this past week sparked concern over 2024’s place in the economic cycle. Will inflation subside enough to lower rates by early spring? Will persistent high interest rates push the economy into a hard landing? Has the risk profile of fixed income securities changed? Our novel analytic process suggests that expectations of the fixed income market tend toward stability.

Our approach tested the stationarity of option adjusted spread and effective yield pre- and post-recession. Stationarity is a statical measure of continuity. If a metric is stationary, volatility is constant, and the metric’s value tends to regress to historical averages. A nonstationary metric sees dynamic changes in time with increased volatility and a departure from historic averages. Bray Farm IA’s method quantified this condition for the option adjusted spread (OAS) and effective yield for three fixed income indices— US Corporate, US High Yield, and Emerging Markets Corporate bonds (ICE Bank of America Indices).

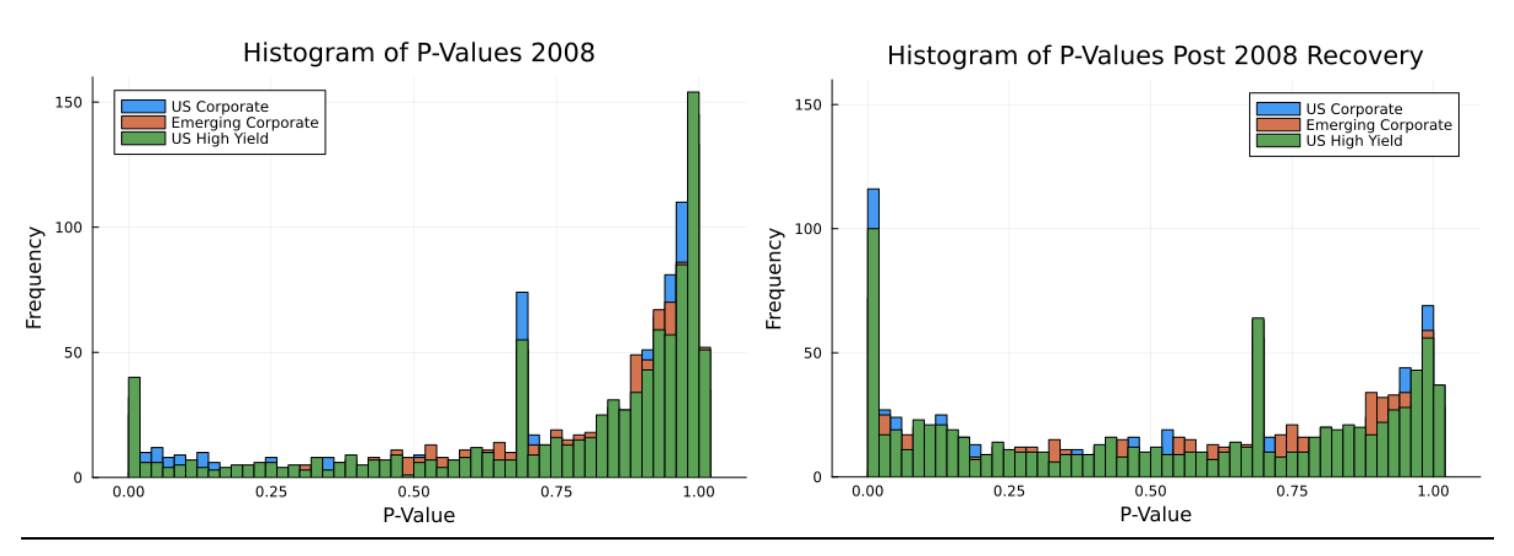

The results of our study showed a significant difference in stationarity between pre- and post-recession economic conditions. Before a recession, the OAS and effective yield both display signs of dynamic volatility and a departure from expected values. After a recession or in bull markets, the OAS and yield see relative stability.

Results of our analysis pre (left) and post (right) 2008 Recession. Values clustered toward 1 indicate non-stationarity and changes in the economic regime. Values clustered toward 0 imply stability in volatility and value.

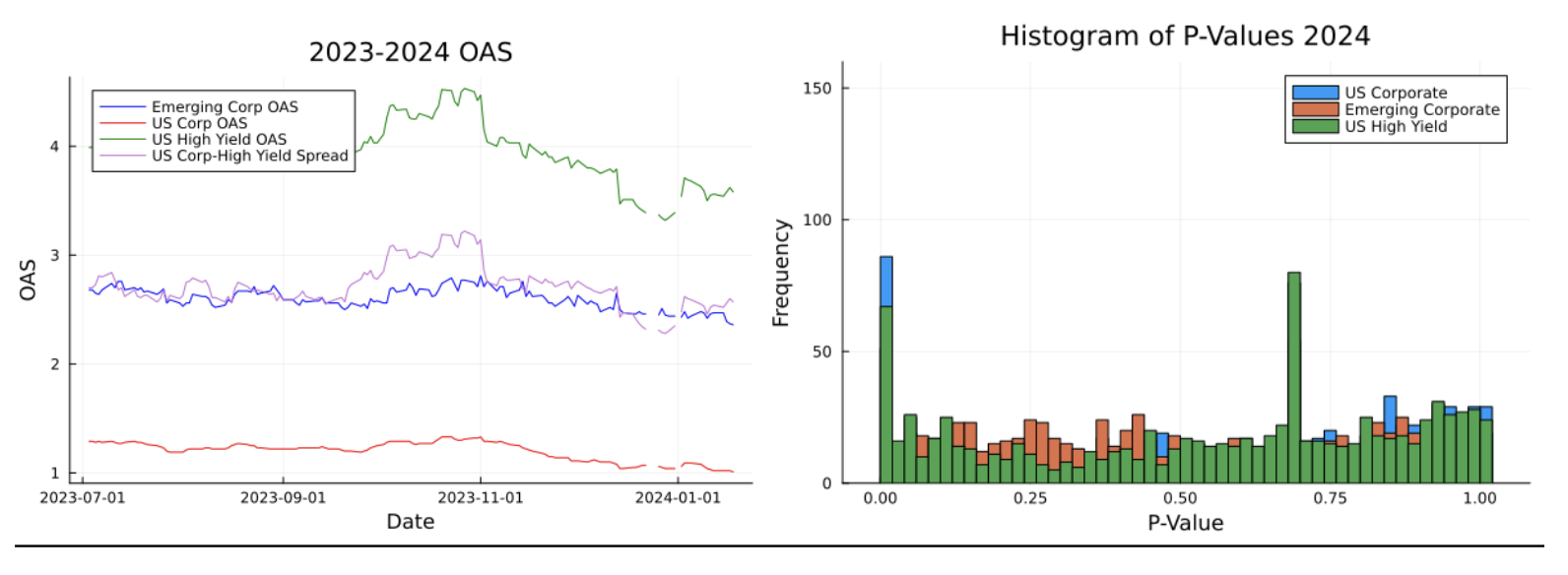

We applied our method to the last six months from present. The second half of 2023 more closely resembles a post-recession than pre-recession period. The market is presenting a stable expectation of credit risk. Investors have felt comfortable with risk levels and expect continuity. The OAS stationarity of 2023 indicates that investor perceive stability entering 2024. The question remains whether the continuing high-interest environment will drive fluctuations in the market risk regime. Early indicators suggest that OAS has not experienced major shocks from the announcement. The high-rate environment appears to be in line with market expectations from 2023. Macroeconomically, the factors pushing fixed-rate securities are stable, barring major shocks.

Raw data of OAS (left) and results of stationarity analysis (right). The analysis presents a clustering around the 0 value, suggesting stability. The spike at p = 0.70 is an artifact of the statistical technique and are not indicative of market behavior.